Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average declined 88.80 points or approximately 0.85% to finish the week at 10,318.16 In looking at the charts of the major market and various sector indices, it looks like the overall market may be in for a slight pullback this week. It should be noted that this week has a fairly heavy economic calendar, and in particular the GDP announcements on Tuesday and the Personal Income & Spending announcements on Wednesday could easily cause big moves in the market or reversals of existing trends.

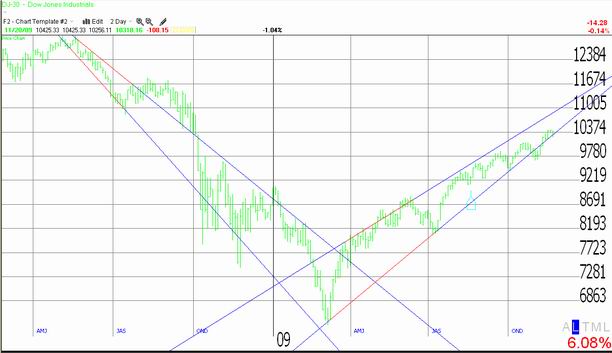

In the August 24th edition of the Sterling Weekly I took a look the parameters for a typical market retracement. A 1/3 retracement on the Dow Jones Industrial Average would have taken the Dow to 9,086.21, a 2/3rd retracement would have taken the Dow to 11,625.37, and a 50% retracement would have taken the Dow to 10,355.79 It should be noted that the recent high on the Dow is 10,437.42 It should also be noted that it was on October 6th of last year when an already declining market more or less fell off a cliff. On October 3rd, the Friday before Monday the 6th, the Dow Jones Industrial Average closed at 10,325.38 I have included a 2 day chart (with trendlines) that shows the movement of the Dow over the last 18 or so months, and what appears to be a fair amount of resistance against any further upward movement.

In the June 22nd edition of the Sterling Weekly I took a look at the price of Gold and forecast a target price of $1,300 per ounce. In the September 14th edition of the Sterling Weekly, I recommended the SPDR GOld Shares ETF 'GLD' as a way to play the upward movement in the price of Gold. It should be noted that the 'GLD' closed the day before I published the September 14th edition of the Sterling Weekly at $98.90 per share. Since then the price of Gold has reached $1,146.80 per ounce, and the 'GLD' closed last Friday at $112.94 per share. Based upon my take of things, it looks like the price of Gold still has a lot of upside. Unfortunately, I think the upward movement in the price of Gold, is somewhat a no confidence vote on the US economy.

|