Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average lost 173.30 points or approximately 1.7%, to finish at 10,012.23 Starting early last fall I began having conversations with my wife concerning further advancement in the overall market in 2010, and in late November of last year I began to voice those concerns to my readers starting with the November 23rd edition of the Sterling Weekly; and in the January 25th, 2009 edition of the Sterling Weekly I stated that I thought the Dow Jones Industrial Average could test 9,712.73 on a closing basis. While I will admit I was not expecting this sharp of a pullback, the fact of the matter remains that we are in the process of experience some sort of a pullback. The question becomes is this a short term pullback or the start of a larger downward trend.

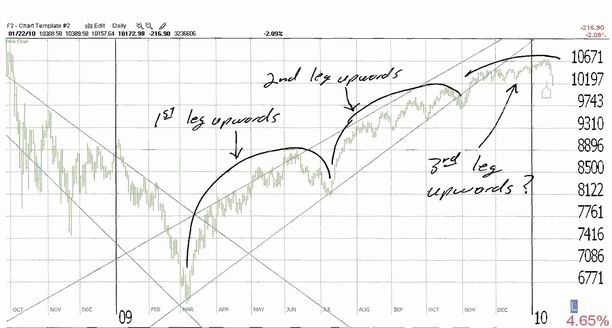

In the January 25th, 2009 edition of the Sterling Weekly I published the chart below showing what I thought were the three upward legs to the market rally that started in March of last year. The question concerning that 3rd leg upwards is when do you consider it to be broken? I think the close on the Dow below 10,092.19 signal the breaking of the 3rd leg of the upward trend. My thoughts are that the Dow Jones Industrial Average is going to continue to move lower and test 9,712.73 on a closing basis. If the Dow closes below that level, then I see the next point of support coming into play on the Dow at 9,487.67

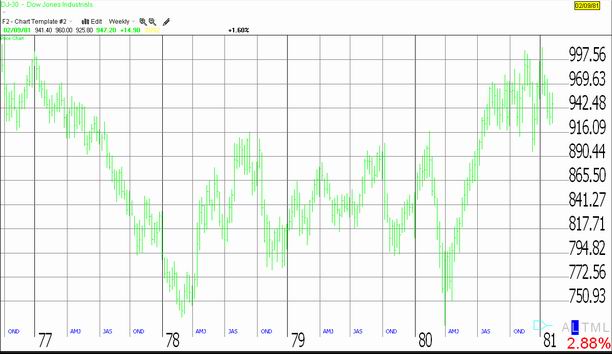

For as long as I have been writing I've said that politics is the number one influence on the market. I really hate to say it, or in this case write it, but I really feel that the market is pulling back as a result of the bad policy proposals and decisions coming out of Washington. I really wish the market was doing better and I was writing about another sector index that was looking good; but the market isn't doing well and all the sector indices I track look to be moving lower. I don't feel like getting into a lot of details on what I think is going wrong with the policy decisions. Maybe I'll put that in one of my blogs, or in another edition of the Sterling Weekly. However I feel like we are going to relive the Carter years, when Jimmy Carter was President. So I thought I would include a chart of the market during the Carter years.

Let's not forget that the Carter presidency was marked by unpopular policy decisions including the Panama Canal Treaty, foreign policy set backs including the Iranian Revolution, the Iranian Hostage Crisis, and the poor economic decisions including the Windfall Profits Tax, and the Russian Grain Embargo. This all helped contribute to a period marked by rising inflation and stagnate economic growth, hence the term stagflation. My concerns are that this go around this could be worse than they were in the late '70's. Time will tell.

|