Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average gained 75.95 points or approximately 0.7%, to finish at 10,642.15 The Dow continued its upward move last week, even if it was at a slow pace. In my review of the charts from Friday's trading activity I noticed that the S&P 500 'SPX' set a new yearly high on Friday.

Typically the Dow Jones Industrial Average will be setting new highs as well when the S&P 500 is. Experience has taught me that when the S&P 500 sets a new high, if the Dow doesn't do so as well within a few days, it is usually a precursor to a market pullback. Now we still have a few days to go, and I am not trying to sound any alarms right now; but I would like to point out that the S&P 500's yearly closing high was 1,150.23 set on January 19th, and it closed at 1,150.51 on the 11th of this month. This could potentially be a "double top" of upside resistance. If the next few days are to the downside, then this would tend to support the idea of the formation of a "double top" point of resistance. However if we are up over the course of the next few days, and the Dow confirms the move by closing above 10,725.43, then I would look for the S&P 500 to move towards 1,243.72 on a closing basis.

I should point out that as I finished the writing of this week's Sterling Weekly that I noticed that the S&P 100 'OEX' has not yet set a new yearly high.

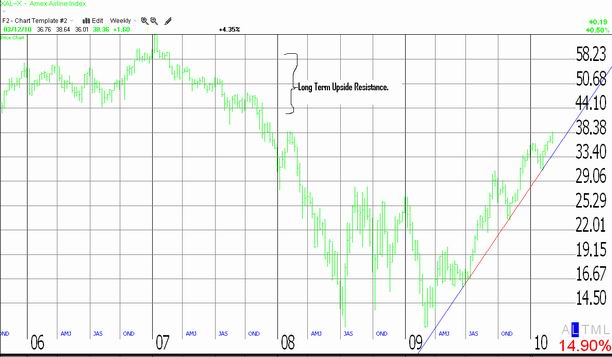

In this week's edition of the Sterling Weekly I wanted to take a look at the NYSE ARCA Airline Index 'XAL' which set a new yearly closing high on Friday, closing at 38.36. This makes the NYSE ARCA Index 'XAL' one of the better performing indices over the course of the last 12 months. The 'XAL' tracks the price performance of major U.S. and overseas airlines. The 'XAL' Index was established with a benchmark value of 200.00 on October 21, 1994. I've inserted a recent chart on the 'XAL' below for your review.

Since coming off its lows in late June of last year, the 'XAL' has established a upward support line that appears to be a major influence on the index. Additionally I have identified a pair of cup patterns on the 'XAL' with the last one providing for a measured move to 40.61 I feel confident with the 'XAL' moving to this level, and a review of the long term chart of the 'XAL' below shows that the 'XAL' should be able to move up to about 43.50 before it starts to see significant upside resistance that will most likely take some significant time to break through.

I could only really find one (1) ETF that tracks the NYSE ARCA Airline Index 'XAL', that is the Claymore/NYSE Arca Airline ETF 'FAA.' The Claymore/NYSE ARCA Airline ETF 'FAA' seeks investment results that correspond generally to the performance of the 'XAL.' In comparing the chart of the 'FAA' with the chart of the 'XAL' there is an extremely high correlation between the two, making the 'FAA' an excellent ETF to track the 'XAL.' I calculated a measured move on the 'FAA' to $36.62, considering that Friday it closed at a $35.14, that doesn't leave for much upside. However if we see the 'XAL' make a move to the 43.50 level, then we could see the 'FAA' reach the $41 to $42/share range. |