The overall market appears to have found some support last week. The Dow Jones Industrial Average having risen from 8,451.19 at the time of the publication of our previous edition of the Sterling Weekly to 9,265.43 with yesterday's close. This is a gain of 814.24 points or approximately 9.6%. It looks like the market is poised for at least a short term rally, as I am expecting the Dow Jones Industrial Average to continue to move higher and test 10,325.38 However I think any rally beyond that level may prove to be difficult.

In the July 21st edition of the Sterling Weekly I listed five (5) factors I thought were weighing on the market. They were Financial System Weakness, High Oil Prices, Dollar Weakness, Taxes, and Political Uncertainty. I discussed financial system weakness in the August 13th edition, and the price of oil in the September 9th edition, and Dollar Weakness in the September 15th edition, of the Sterling Weekly. Since then we have seen the price of Oil fall by almost 50%, and the US Dollar strengthen against the other major currencies of the world. This week I want to look at the tax issues facing our economy and markets.

One of the most important issues in the upcoming election is tax policy, and I would like to take this opportunity to provide a brief discussion about its effects on the economy, the basic policies of the Presidential candidates, and what I feel needs to be done in order to create the tax environment that provides for a healthy economy. Our two (2) Presidential candidates have dramatically different view of what the tax policy should be for this country. I have stated for a long time that I believe "politics is the single biggest influence on the market and economy," and as a result I feel it is important that we at least acknowledge the differences between our two Presidential candidates.

In a nutshell, John McCain favors leaving the Bush Tax Cuts in place, essentially keeping tax rates unchanged; and Barrack Obama wants to let the Bush Tax Cuts expire, and then enact his own version of a tax cut. The expiration of the Bush Tax Cuts will amount to the largest post-war tax increase for Americans. Economics 101 teaches us that the more you tax something, the less of it you get; raising taxes on the economy will lessen a/k/a slow down the economy. Raising taxes during a period of economic weakness will further slow down the economic growth of the country and deepen a/k/a worsen any recession, additionally it will cause tax receipts to be lower than expected and therefore contribute to a larger budget deficit. Mr. Obama's planned taxed cuts will not offset the negative effects of allowing the coming tax increase due to the expiration of the Bush Tax Cuts. Mr. McCain wants to extend the Bush Tax Cuts. This isn't a fresh tax cut, it is preserving things as they are. The differences in the two (2) tax policies of the Presidential candidates creates a level of uncertainty that will not be resolved until after the election on November 4th, and depending on who actually wins, it may take longer than that.

My professional (and personal) opinion is that what is needed in a time of economic weakness is a simplification of our tax code that makes our economy more competitive in world markets. With that in mind, I thought this would be a good opportunity to look at the current tax code and the 2 primary alternatives, the Fair Tax a/k/a national sales tax, and the Flat Tax.

1. The Current Tax Code: Our current tax code is known as being a progressive tax code because it imposes progressively higher tax rates as income levels rise. It is sometimes referred to progressive because it that implies it is fair to have higher income individuals pay more income tax than lower individuals. It is a very complex, convoluted, and confusing tax code that is riddled with loopholes and in effect provides plenty of opportunities for people to avoid paying taxes. Additionally it allows the government to pick & choose winners and losers in the economy, and that if effect distorts the economy in a manner that harms people and businesses. Our current tax code is in desperate need of an overhaul.

2. The Fair Tax: Call it what you want, a national sales tax, a consumption tax, the Fair Tax is a tax on spending. The proponents of this tax argue that it has the benefit of eliminating the IRS, that it captures taxes from all the illegal immigrants, and eliminates tax loopholes and forces everyone to pay taxes. I've got two (2) basic problems with the Fair Tax. A.) As a national sales tax, it will probably have a very negative effect on the economy. It will most likely hurt the consumption and production of big ticket items, and a whole host of other goods and services. This will ultimately cost the US economy jobs. B.) My second major problem with the Fair Tax is that middle and lower income spend a higher percentage of their incomes and has a result will pay a higher percentage of their income in taxes than they do now, and they will pay a higher percentage of their income in taxes then upper income people would under the Fair Tax.

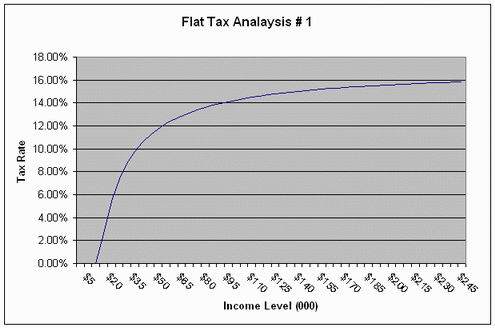

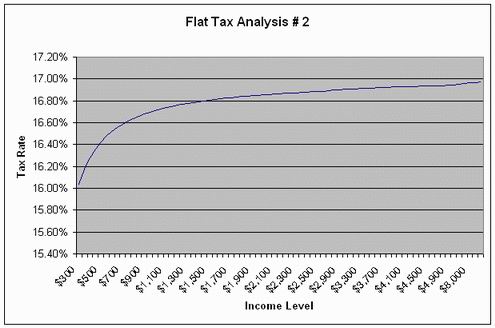

3. The Flat Tax: I first read about the Flat Tax in a Wall Street Journal article in the early to mid 1990's. I believe the article was authored by Representative Dick Armey who claimed that a flat tax of seventeen percent (17%) with a twenty-seven thousand dollar ($27,000) personal deduction was scored by the Treasury as being revenue neutral, meaning it would bring in as much revenue as the current tax code. The other major claim is that it would eliminate inheritance and capital gains taxes, and a person's tax return could fit on a postcard. Now the critics of the Flat Tax have typically come up with two (2) main criticism of the Flat Tax, that A. the Rich pay the same tax rate as the poor, which isn't true due to the personal deduction, and B. that it is a tax increase for the poor. Well, both those arguments against the Flat Tax are false. I created a table showing the taxes paid on incomes from $5,000 to Ten Million Dollars, and the effective tax rate paid. As the table clearly shows the effective tax rate starts out at Zero Percent (O%) and rises to a high of 16.954% on an income of Tem Million Dollars. I have also included below on incomes from $0 to $250K, and a second chart showing incomes from $250k to $10,000,000. The charts clearly show that the percent of income paid in the form of taxes clearly rises all along the scale and incomes rise. Simply put, the more money you make, the greater your effective tax rate.

So, the 1st argument against the Flat Tax is false. I've done an informal survey of friends and other people I know regarding whether the Flat Tax results in their paying more taxes or not. The results have essentially come down to either paying the same level of taxes or less. While I know the results may not be "scientific," I would like to point out there are so many different individual deductions that it may not be possible to know for sure. So, the 2nd argument against the Flat Tax doesn't bear out either.

The Flat Tax Tax eliminates many of the punishing portions of the current tax code that discourage savings and investment. Additionally it should be noted that those countries around the world that have a Flat Tax have strong and fast growing economies, and have typically been able to avoid the periodic recessions that plague other economies. Our current tax code should be scrapped in favor of the Flat Tax.

I don't claim to be an expert on either of the three (3) tax systems mentioned in this edition of the Sterling Weekly, but then again you don't need to be an expert in order to grasp and understand the basic principals of either; nor do I pretend that what I have written is all that their is on the subject. My goal was to point out that there is a better system than the one we have out there, and to present a simple analysis for everyone to review of the two (2) most common criticism of the Flat Tax. A copy of the spreadsheet showing the taxes paid and the effective tax rate on the various income levels can be found (here). Additional information on the Fair Tax can be found at www.fairtax.org or at the Wikipedia site (here). Additional information on the Flat Tax can be found on the Freedom Works web site (here) or at the Wikipedia site (here).

|