I must apologize for the couple of weeks that has elapsed since the last edition of the Sterling Weekly. I am in the process of preparing for hip replacement surgery, and as a result my work schedule has been somewhat erratic lately. Due to the fact that there is a good chance my publication schedule will most likely be somewhat erratic, I have decided to make the Prime Stock Newsletter free to the public until July 10th, 2009. I should be more than recovered from the surgery by then and we should be seeing any more interruptions in the publication schedule. If you would like to take advantage of the free subscription offer, please click (here).

Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average 'INDU' has risen 443.32 or approximately 5.4% to close last Friday at 8,574.65 The overall market appears to be poised to move higher. I am expecting the Dow Jones Industrial Average to continue to move higher and test resistance at 9,034.69

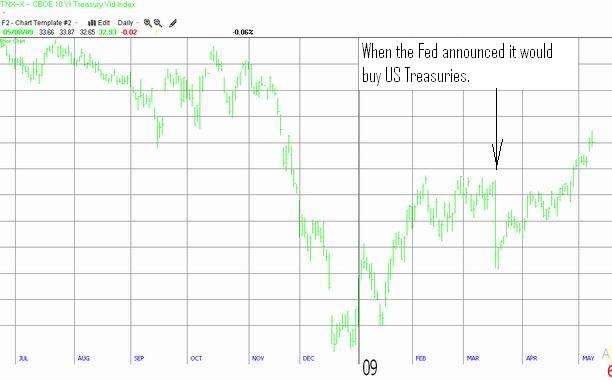

A lot has happened in the market in the few weeks since I wrote the April 20th, edition (the previous edition) of the Sterling Weekly. Since then the market has rallied nicely. However, since then US Treasury Bonds have continued to decline in value sending interest rates higher. In the March 16th edition of the Sterling Weekly, I wrote that I felt the yield on the 10 year Treasury Bond should be in the 4.0% to 4.5% range. Well, on approximately March 17th, the Fed announced that it would selectively start buying US Treasury instruments in order to drive interest rates lower. The next day the bond market rallied sharply and sent interest rates dramatically lower. The yield on the 10 year US Treasury as measured by the CBOE 10 Year Treasury Yield Index 'TNX' closed the 17th at 2.999% and finished the 18th at 2.545%, a tremendously big move. Well on April 28th, the 'TNX' closed at 3.002%, above where it was when the Fed. announced that it wanted to drive interest rates lower, and Friday the 'TNX' closed 3.293%. Well it seams that the there is a very good chance the yield on the 'TNX' is going to move back into the 4.0% to 4.5% range as I thought it would. S, it begs to ask the question, what good has the Fed's buying of Treasury instruments gotten us? Has it succeeded in driving interest rates lower? Or has all the money it has pumped into the system simply helped light the fire on inflation and ultimately will it have the opposite effect and drive interest rates even higher than they would normally be?? Well, my best professional opinion is that the buying of treasury bonds by the Fed is going to cause inflation to rise, and to undermine the value of the US Dollar. A depreciating currency and rising inflation is no way to have a healthy and growing economy. It sounds like a recipe for stagflation in my opinion.

|