The overall market as measured by the Dow Jones Industrial Average gained 597.04 points or approximately 9.0% last week to finish at 7,223.98. The major items that appear to have sparked the rally was the announcement that the major banks had been profitable during the 1st quarter of 2009, and the House subcommittee holding hearings on "mark to market" accounting instructed FASB to come up with an alternative to mark to market accounting. It looks like the Dow Jones Industrial Average will continue to move higher. It should test the upside resistance at 7,552.23 and if it closes above that level, it will probably continue to move higher and test the upper of the 2 downward trendlines that have been influencing the market for the last 4 months. I am currently estimating that to be approximately 7,775 Also, it looks like that trendline is deckling at approximately 18 points per day. However I doubt the Dow Jones Industrial Average will move much higher above those levels. The chart below shows the Dow Jones Industrial Average and the trendlines mentioned above.

On this week's economic calendar we have the Producer Price Index 'PPI', the government's measure of inflation at the wholesale level; and the Consumer Price Index 'CPI', the government's measure of the inflation at the consumer level. These reports are important because they strongly influence monetary policy, or at least they are supposed to if our President of the Federal Reserve is doing his job.

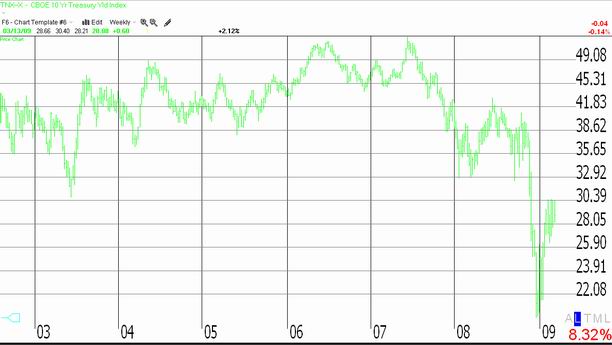

In order to maintain solid economic growth, a country needs to have a stable monetary policy that produces a stable currency and a low inflationary environment. The Fed Funds Rate is the primary tool through which the Federal Reserve Board influences monetary policy. As I wrote in the August 15th, 2005 edition of the Sterling Weekly "historically the Fed Funds Rate has been approximately 1.25% above the rate of inflation,..." This is the level of Fed Funds that historically keeps inflation under control and produces a stable (non-declining) currency that is vital to international trade. Well, the year over year change in the core rate of the CPI is approximately 1.7%, this implies that the Fed Funds should be at approximately 3.0%, substantially higher than where it is now. This is also significant, because all the other long term rates are based off of the Fed Funds rate. With the current yield on the 10-year government bond currently at 2.888%, I think that yield on the 10 year bond should be in the 4.0% to 4.5% range to be in line with its historical levels, as the chart below shows.

The reason I am discussing this is that we are now in the process of producing the largest federal deficits as a percentage of GDP since World War II, and all the money the Federal government is pumping into the economy is going to have an inflationary effect, sooner or later it will cause inflation to increase and pick up. As we learned from the Carter years, rising inflation will require substantially higher interest rates to combat the damaging effects of high inflation. So here is what I am looking at, the huge budget deficits and the efforts to keep mortgage rates artificially low will probably produce and inflation rate of somewhere in the range of 6-8%. This will require Fed Funds to be somewhere in the neighborhood of 7.25% to 9.25%

During the middle part of this decade when investors felt the Federal government had inflation under control, they were basing housing mortgage loan rates off the 10 year government bond. Well, if we see the Fed Funds rate at 7.25% to 9.25%, it would be reasonable to expect that the 10 year bond yield would be somewhere in the range of 10-15%. If mortgage loan rates continue to track the 10 year bond yield, then the affordability of the US housing market is going to decline very dramatically. Under this scenario, and I expect that I am not too far off base, I would be avoiding longer term government bonds and companies tied too closely to the US housing industry. And by the way, all those housing programs announced by the Obama administration that are designed to prevent foreclosures, I don't see them working under any scenario and I am pretty sure they will simply delay the recovery in housing and further cause our deficit to grow out of control.

|