Since the previous edition of the Sterling Weekly the Dow Jones Industrial Average rose 278.44 or approximately 2.5% to 11,362.19 The overall market continues to look positive, however as I write this week's Sterling Weekly I do have some concerns that the S&P 500 might be bumping up against an up against a trendline that may provide some short term resistance and contribute to a short term pullback. Or, we could trade right though it. Oil closed today at $89.38 per barrel, and with the price of Oil close to $90 I thought I would take a look at the chart for January's Oil futures contract and the Amex Oil Index 'XOI' and see what they are telling us.

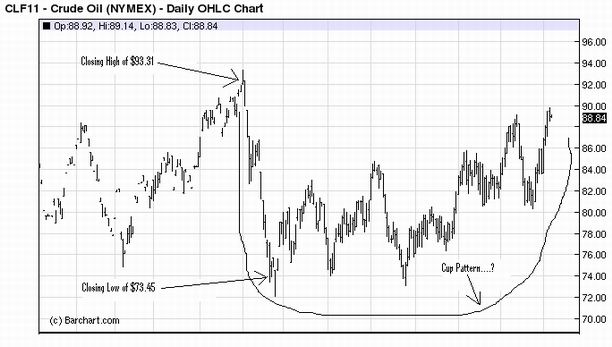

I've inserted a 1 year chart below for the January 2011 Oil futures contract. In looking at the chart of the January 2011 Oil futures contract, it appears that price of Oil for January delivery is in the process of testing $93.31 per barrel. If the prices of Oil for January delivery closes above $93.31 per barrel, then it will have completed a "cup pattern" with a measured move to $113.17 per barrel.

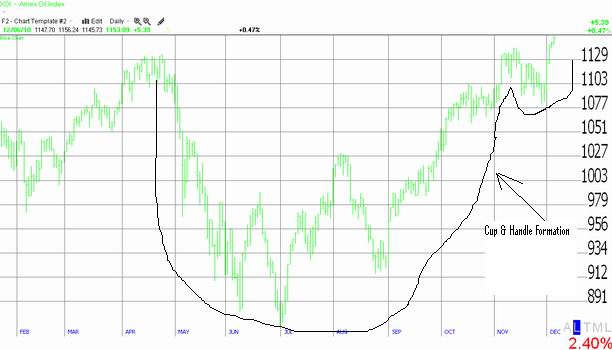

We have seen the price of Oil get close to $90 per barrel before only to fall back down below $80 per barrel, so I thought it might be wise to look and see if there might be something we could take as a confirmation of the likely hood of a movement higher in the price of Oil. So, I decided to look at the Amex Oil Index 'XOI'. I've inserted a chart on the 'XOI' below. The 'XOI' has completed a "cup & handle" pattern. This is a very bullish trading pattern that produces highly predictable measured movements. This pattern is forecasting a short term move to 1,189.98 on a closing basis; and on a slightly longer term basis a move to 1,389.50. Right about where I would expect the 'XOI' to be if the price of Oil reached $93.31 and $113.17 per barrel.

Investors looking to trade this potential movement in the price of Oil the 'XOI' have several options. For those looking to trade the movement in the 'XOI', the SPDR Energy Select ETF 'XLE' closely tracks the movement in the 'XOI'. For investors looking to trade the movement in the price of Oil the US Oil Fund ETF 'USO' is designed to allow investors to participate in the oil futures market.

|