Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average gained 255.37 points or approximately 2.3%, to finish at 10,997.35 The overall market overall market continues to look positive; and I must admit I am happy to finally see some divergence in the performance of the various sector indices. The market in general has a tendency to overreact to both the upside and the downside. This is just a normal part of the market's function, and is nothing to be worried about, but is something that should be acknowledged. During periods of overreaction the broad market tends to move in unison, or the same direction. This was true during the downturn in the 1st half of 2009, and the subsequent rally through the remainder of 2009. While this type of movement may seem somewhat idyllic, it doesn't really provide the ideal trading environment some might imagine.

I used to have a bond manager when I first started in the market that was fond of saying there was always a bull market somewhere; and the flip side of that is that there should always be sectors that are not performing. This divergence in the performance of the various sector indices helps create the volatility that traders need to generate substantial profits, economically it helps direct capital to the most profitable areas of the economy.

My belief is that uncertainty creates this lack of divergence that causes the market to move in unison to the upside and the downside. Uncertainty as to how bad things might have gotten caused the entire market to move lower in the 1st half of 2009. The realization that things were not as bad as feared caused an united rebound after the lows were set in March of 2009; and uncertainty how new legislation and regulatory changes would affect the economy and market kept the various market sectors locked in a relatively united movement. As this uncertainty has cleared, the various sector indices have unlocked and started to move independently based upon their own fundamentals.

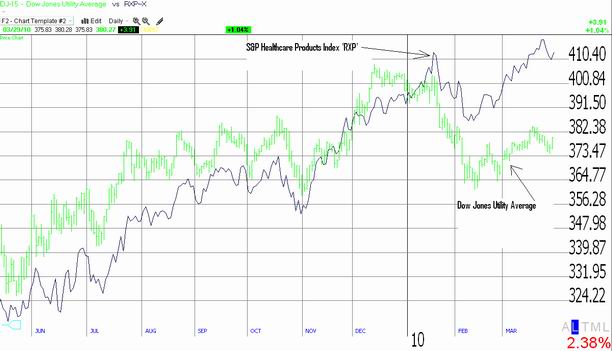

I've inserted a chart below showing the diverging performance of the Dow Jones Utility Average when compared to the S&P Healthcare Products Index 'RXP' which recently set a new yearly high.

Please note that this week is the start of earnings season.

|