Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average lost 77.09 points or approximately 0.7%, to finish at 10,325.26. Unfortunately while the overall market appears to be tracking sideways with a downward bias, the intra-day volatility continues to be rather severe with the Dow Jones Industrial Average making intra-day swings of a couple hundred points during the day only to finish the day slightly changed. This to me indicates a great deal of uncertainty about the mid to long term direction of the market.

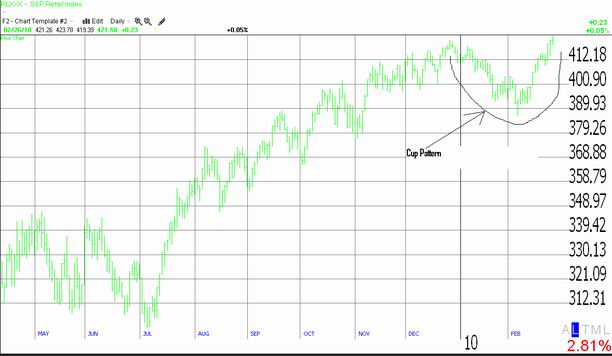

In this week's edition of the Sterling Weekly I wanted to take a look at the S&P Retail Index 'RLX' which set a new yearly closing high on Friday. This makes the S&P Retail Index 'RLX' one of the better performing indices over the course of the last 12 months. The 'RLX' is designed to track the performance of the US retail industry. I've inserted a recent chart on the 'RLX' below for your review.

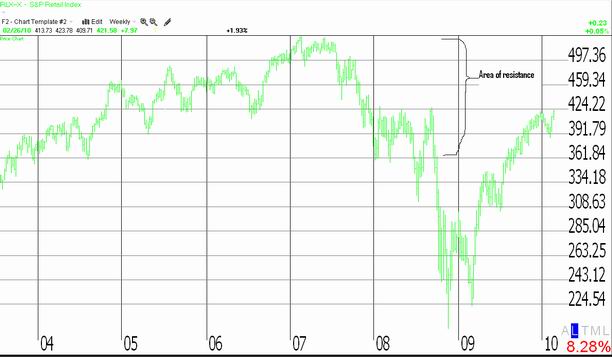

As you can see from the chart, the 'RLX', which closed Friday @ 421.58, has completed a small "cup pattern" with a measured move to approximately 445.53 on a closing basis. While this is positive over the short term, I would like to offer a point of caution on a longer term basis. As the longer term chart on the 'RLX' below shows, the 'RLX' has now re-entered an area of upside resistance that has held it somewhat range bound for a period of approximately four (4) years of trading prior to last year's pullback. In other words I would not be expecting a move to the 497 or higher level any time soon. Additional information on the 'RLX' can be found (here.)

I would like to point out that this week has a very heavy economic's calendar with the big news being at the end of the week with the unemployment report. However I would not ignore the personal income and spending reports at the start of the week either.

|