Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average rose 78.98 points to finish the week at 10,388.90 I was out of the office and traveling for 3 days last week at a convention in Las Vegas. I always find travel interesting because it give you chance to see what other people are talking about in different parts of the country. While I was in Las Vegas, the buzz focused on the drop off in the convention and casino business this year. Almost universally the locals I spoke to blamed President Obama and the other Democrat's in congress for making the decline worse than it needed to be by demonizing Las Vegas as a place to hold business meetings. The other interesting things the "locals" were talking about was the unionization of the casinos and how it was bad for both the customers of these casinos and the casinos themselves. While I was flying back to Atlanta I sat next to a very nice elderly couple. One of the things they talked about was that they had been holders of General Motors bonds prior to the bankruptcy filing. They rightly believed as senior creditors they should have been second (2nd) in line in any bankruptcy reorganization instead of being wiped out as they were. They were more than a little miffed at the Obama administration for giving such a large percentage of the company to the Unions who should have received nothing under normal bankruptcy proceedings. Well, I've often said there is nothing more determined than an organized victims group; and it looks like I meet two (2) of them on this trip, and they tend to have long memories. If that is the case, then it looks we are going to be in for some changes in not just 2010, but 2012 as well.

One of the more common questions that I hear is "where do we go from here?" It is usually asked following comment about how well the market has done since it rebounded from its lows earlier this year. It might be more important to ask ourselves how much more upside should we expect? One of the major factors in determining where the market goes from here, and how much more upside we should expect is the American consumer. The American consumer is a major force in the American economy, and how the consumer fairs will also be a major determining factor in how the overall economy does. The Morgan Stanley Consumer Index 'CMR' is an index designed to track the shares of companies that focus on the American consumer. I have inserted a 3-day chart of the 'CMR' below. We can that the index has rallied nicely from its March lows and has now reached levels where the index traded for almost all of 2008.

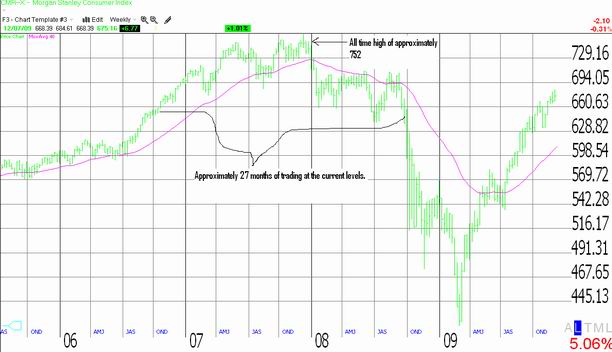

Below I have inserted a weekly chart of the 'CMR.' In looking at this longer term chart of the 'CMR' we can see that when the economy was performing at its peak, the all time high on the 'CMR' was approximately 752. The 'CMR' closed at 675 on December 7th of this year, needing to rise approximately another 11% to reach the 752 level. While that may not sound like much given recent market history, let stop and ask ourselves a couple of key questions. 1. How is consumer spending going to reach the 2007 levels with unemployment having risen from approximately 4% to 10%?? 2. How is consumer spending going to reach the 2007 levels with the banks having tightened credit so dramatically?? I don't think consumer spending can return to those levels given the current state of the economy. Additionally take a look at the chart below, the 'CMR' spent approximately 27 months trading where I have identified upside resistance. In my opinion, the market is going to need a long time for the 'CMR' to chew through all that overhead resistance; probably anywhere from 18 to 36 months.

So where do we go from here?? How much more upside do we have left?? Well, I think our future upside is rather limited for the time being. I think at best the overall market is going to track sideways for quite a while, if we are lucky. The real risk I see is that consumer spending does not return and the market then moves back lower. If that happens, then economic recovery will depend upon businesses to generate the growth that eventually brings the consumer back.

|