Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average declined 8.94 points to finish the week at 10,309.92 I was out of the office and traveling for 2 days last week on a consulting project. While I was away from the office I had several meetings with individuals from the United States, Canada, and Latin America. A continuing theme to our conversations, and somewhat to the general tone of discussion this entire year, is what to do with the current market??

What made last week's conversations somewhat different is that they included non US citizens with a more international outlook than your typical American. Unfortunately the underlying theme is the same, no one has any confidence in the current administration and congress's ability to provide for an economic climate that allows businesses to grow and thrive; and everyone is concerned that the deficit and debt levels are going to destroy the US Dollar and the US economy along with it.

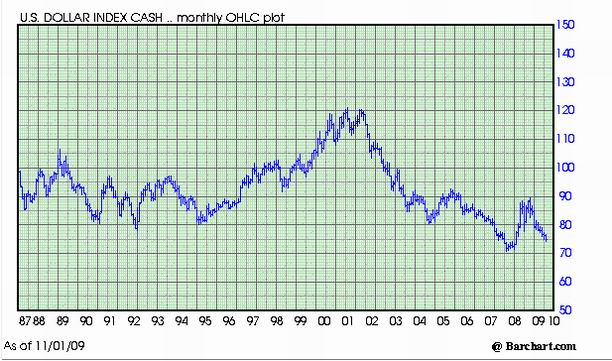

The chart above shows the decline in the US Dollar as compared to the other major currencies. Most of the financial press is talking about the decline in the Dollar, and as a result, almost everyone I know is talking about moving their spare cash out of US Dollars and into another currency. The problem is that most people don't really have any idea which foreign currency they should be buying, or how much lower the Dollar can really go. In order to help answer that question I have inserted below a 25 year chart on the US Dollar Index.

I am not an expert in foreign currency transactions, but I would like to think I am pretty good at reading a chart. Unfortunately my read of the chart above leads me to believe that if we see the US Dollar Index close below 70, then we could easily see a move to 50 on the US Dollar Index. While that may be good for the export sector of our economy, I don't see how it is good for any other sector. In the next few weeks I see if I can start answering that question on how to take advantage of the weakening US Dollar.

|