The overall market as measured by the Dow Jones Industrial Average lost 302.74 points or approximately 4.1% last week; additionally the Dow Jones Industrial Average another 336.91 points or approximately 4.7% in the 1st two trading days of this week. With today's close of 6,726.02 on the Dow Jones Industrial Average it has closed at is lowest level since April of 1997. In looking a chart of the Dow from the mid 90's I see support coming in at 6,547.79 and then 6,391.69. After that, the next level of support in the 6,000 range is at 6,286.35 if that support level fails to hold then we do not see the next level of significant support until around the 5,800 to 5,700 level on the Dow. OUCH. I think there is a realistic chance we will see the Dow Jones Industrial Average at that level (5,800) sometime within the next 60 days.

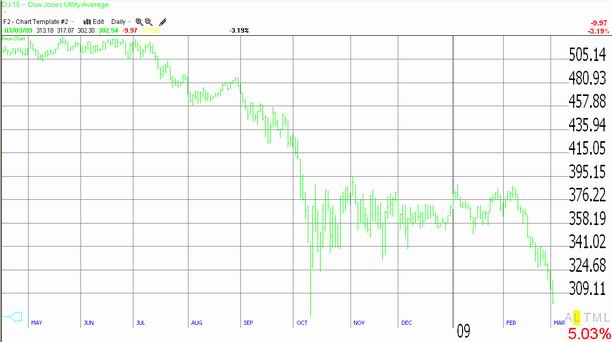

As I discussed in this morning's Prime Stock Newsletter, there is normally a bull market somewhere at all times, but not this time. I look at roughly 40 different sector indices every day, they pretty much reflect all segments of the US economy. There is not a single sector index that is performing well in the current market environment. Normally the utility companies would be a "safe haven" investment during troubled times, but not this time. The chart below is a chart of the Dow Jones Utility Average. Normally during periods of economic recession the utility stocks, and utility average will out perform the mainstream companies in the stock market, especially the Dow Jones Industrial Average; but not this time. They have pretty much tracked the movement of the overall market lower.

So, one has to legitimately ask "why not this time??? What is different?" Well keep in mind the market is forward looking. It is much more focused on expected future results than what happened in the past. Right now the biggest issue facing the utility companies is the concern over the much discussed Carbon Tax, sometimes called "cap and trade" or sometimes called "tax and trade." There is a limited amount of information available on the subject, but it appears to focus on 2 main points. The 1st being that every emitter of carbon dioxide is going to need to purchase the right to emit CO2. The second is that they will be taxed based upon the amount of CO2 they emit. The goal of the taxation policy is to increase the cost of the carbon based energy production to make Alternative Energy production cost competitive. A recent article I read in the Wall Street Journal suggested that this would cause between a 200-300% increase in electric and gas utility costs. Since it is highly doubtful the public could sustain such an increase in its utility costs, the most likely result would be that the utility companies would not be able to get the necessary regulatory approval to raise their rates and as a result their profits would suffer dramatically. Of course I could be wrong about all this, but you take a look at the chart above and tell me what you think the market is saying about the proposed carbon tax and its effects on the utilities.

|