Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average rose 190.14 points, or approximately 1.8%, to finish at 10,618.19 In last week's edition of the Sterling Weekly I looked at the various sector indices I track and how they had performed over the course of the last year and the decade as a whole. Absent from my discussion was the interest rate indices. I purposely left them out of the discussion due to their inherent differences from a stock index, the average person cannot buy or short an interest rate index. Additionally interest rate indices do not represent something that actually grows, they are basically designed to reflect the rate of interest on bonds with a specific amount of time until maturity; and as a result on a longer term basis they basically fluctuate above and below the long term average rate of interest for bonds with that specified maturity rate.

Another way of looking at this is when interest rates are at one extreme or another, they are most likely to regress towards the mean, or in other words reverse course and move back towards the long term average. But like most things that swing back in forth, when they move back towards the average they don't just stop at the average once they reach it, they keep moving past the average until they reverse course again and head back towards the average. Just think of the pendulum on a Grandfather Clock. Also, like the pendulum on a clock, the greater the swing to one extreme, the greater the swing is likely to be when it moves past the average.

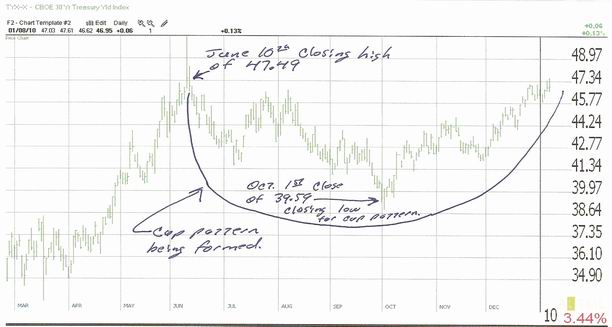

One of the key measures of interest rates is the CBOE 30-Year Treasury Bond Index 'TYX' which closed last week at 46.95 representing a yield on a 30-Year Treasury Bond of 4.965%. I've included the recent chart on the 'TYX' below and it is clear to see that the 'TYX' is closing in on 47.49, the post crisis closing high set back on June 10th, 2009. This is significant because a close by the 'TYX' above that level would complete a "cup pattern" with a measured move to 57.39 or a yield of 5.739% on the 30-Year Bond. Additionally, while I believe the recent large purchases of Treasury Instruments by the Fed is a form of market manipulation on their part to keep interest rates low, I also believe that the 30-Year Treasury bond is also more directly under the influence of long term market forces than the other Treasury instruments.

I think this is significant for two (2) reasons. The 1st being that if longer term rates rise as I expect, then the value of long term Treasury instruments is going to decline dramatically; and secondly because in the overall scheme of things this could very easily be just the beginning of a long term cyclical move higher by interest rates.

Now the question becomes how to play the move higher in interest rates? There are two (2) exchange traded funds designed to move inverse to longer term interest rates that I like. Both are from ProShares a sponsor of over 90 different ETFs. The 1st is the Proshares Short 20+ Year Treasury ETF 'TBF', and for the more aggressive traders the Proshares UltraShort 20+ Year Treasury ETF 'TBT'. Personally, I prefer the 'TBF' to the 'TBT' because the lack of leverage allows it to better track the movement 'TYX' than the 'TBT' does. Additionally I would like to point out that the 'TBF' closed Friday at $50.82/share, and the 'TBT' closed Friday at $50.63/share. I feel that either one of these, depending upon your risk tolerance, is an effective way to profit from rising interest rates.

I would like to point out that the government is set to release Consumer Price Index (CPI) data on Friday. Depending upon your source, it looks like the year over year change in the CPI is somewhere between 1.8% to 2.3%. If this week's release shows continued upward movement in the CPI, then look for additional upward pressure on long term interest rates.

|